Portfolio

AARP MONEY MAP

TIME: 3 MONTHS (MVP) / ONGOING (EXPANSION)

TEAM: SENIOR UX LEAD (MYSELF), PRODUCT STRATEGIST, CLIENT PRODUCT MANAGER, VISUAL DESIGNER, CORE DEV TEAM

MY ROLES: PRODUCT MANAGEMENT COLLABORATION, RESEARCH, PROTOTYPING, VALIDATION, UI DESIGN

We partnered with the largest non-profit in the United States to create a solution serving consumers over the age of 40 on their financial journey, with an objective to create positive, impactful, enduring behavior change in their financial lives. This platform provides tailored information and resources driving consumers to take specific actions in improving their financial well-being.

This project focused on expanding the features of this solution into a completely new area: helping consumers to manage overwhelming debt.

KEY POINTS

-

User involvement in the design process was key to success. We were able to fully validate our problem statements before designing a solution, and were able to validate the solution before and during development to ensure we would be successful in making an impact.

-

Because our time frame was short, we found effective ways to identify with the client, based on user insights and subject matter expert review, the most important features needed to make an impact in a short timeframe. We were also able to gather enough insight to help us plan for many additional improvements.

-

The success of this solution led to the client doubling investment into our team

RESULTS

-

A user-validated MVP was delivered ahead of schedule and expanded with additional features shortly after.

-

Observational interviews showed that users felt notably more comfortable with handling debts after using the tool, felt it addressed their major obstacles, and compared our solution favorably to competitor solutions.

-

92% of users opted to sign up for access with their email address, after seeing the tool prototypes.

-

The client chose to double investment in the team for the next year due to the success of our work.

DISCOVERY

First, we held a series of workshops and meetings to review what we’d already discovered, and to explicitly agree on the next solution’s high level vision, scope and target customer. Then, we agreed on our goals and research objectives, such as learning about consumers’ financial steps, pain points, and perspectives on existing and emerging concepts.

ANALYSIS & INSIGHTS

I reviewed prior foundational research such as customer empathy interviews and prioritization maps for assumed opportunities for potential user value as well as the fit for the client organization.

A well-understood problem is the beginning of a great solution. We set out to gain real customer insight in order to fully understand the debt problem and the impact debt has on real lives.

I interviewed 20 participants using the Respondent platform, screening for the right factors for our target audience. Interviews were around 1 hour each, focusing on a deeper understanding of how debt problems occur, how users are currently solving the problems, and how painful the problems are. We also spoke with them about some of our early solution concepts, showing them some sample screens and designs, to get a sense of whether our assumptions were correct.

Some problem-space questions we asked that we found particularly helpful:

-

What steps did you take when dealing with this problem?

-

What impact does this problem have on your life?

-

Have you found any solutions to this problem so far? What were they?

-

How did that solution work for you?

-

How are you feeling about your situation now?

We also showed early designs for a product which might solve these problems. We asked things like:

-

Would this solution make a difference for you? How? (Or, why not?)

-

How does it feel to use, compared to (solution you mentioned)?

-

Which part of this felt the most valuable to you?

-

If you could change anything about this, what would you change? Why?

-

Would you like to sign up for a notification, so you know when this is available?

How did we know we were ready to start? Our research gave us the key things needed to have confidence in our product:

-

Empathy and understanding of real user problems

-

Knowledge about which features would be the most effective way to solve the problems

-

Evidence of interest in signing up for the solution we were drafting

We ran a Survey Monkey survey with 100 participants in order to get a sense of how common our assumed user problems actually are, and to gather more information about what types of debt people are struggling with the most. We polled users on how these problems impact their personal goals. We also asked them to identify any current solutions they were using. This allowed us to get validation at scale, and to help focus our priorities.

Some of the things we heard were:

"I often feel hopeless when it comes to my debt."

"I need good advice, right now, about how to spend what I do have to pay debt, not how much I should have."

"(Competitor) was really daunting, it felt like it was beating me over the head for paying my medical bills."

We validated that our potential users:

-

Feel overwhelmed by debt, and have little motivation to truly tackle it

-

Often get into debt as a result of job loss or medical expenses on top of pre-existing debt such as student loans.

-

Can’t find a way to pay down debt with the speed they would like

-

Find creditors intimidating or unhelpful to work with

-

Find it too expensive to hire an advisor

Participants during the initial research sessions were shown a variety of potential solution ideas, including tools to provide a free plan for payments, to help them allocate more money towards debt, to speak to an advisor for free, or to link to their bank account and automatically pay debts for them. Of these, potential users gravitated the most towards a free planning tool that provides guidance on which debts to pay, and how much to pay.

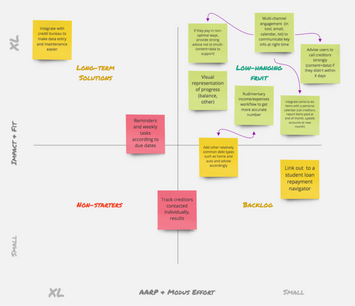

Once research was synthesized into potentially solvable problems and other factors (such as competition, organizational feasibility and strategy fit) were reviewed with stakeholders, the team set out to design a set of potential features to be included in the MVP.

Goals for the MVP and our most risky assumptions outside of consumer research were established and communicated, and our early requirements were documented.

SOLUTIONS

We ran exercises with the client to help answer: How much impact can we make? How likely are we to be able to provide this kind of solution? How well does this opportunity serve our original vision?

Client stakeholders completed a survey to rank solution possibilities and share ideas, red flags, and comments. We created a list of risky assumptions to further validate.

I held collaborative workshops with members of the product, design, and development teams in order to quickly generate alignment for concepts and come up with high quality solutions quickly.

We agreed to validate our solution with both users and subject-matter experts. Screens were linked together in Invision as working prototypes which could be used on a mobile phone.

VALIDATION

I ran 1:1 sessions with potential users who were screened to match our target audience. Users were interviewed about their debt situation and perception of the problem, then given the prototypes to try for themselves. A list of specific tasks was given to each user which matched common use case scenarios. Users were asked at the end of each session about which elements felt the most valuable, which were the most difficult, and what, if anything, they would change about the product.

We ran a survey with 169 targeted participants in order to gather information about consumer debt situations, payment histories, and delinquency to help drive more use case prioritization.

As a result, we were able to gain confidence in the solution concept, and capture potential improvements to be made. We created an initial requirements document and specific algorithm logic so that the product could begin to come together in higher fidelity.

"It feels like a partner. It's not just spitting the numbers out."

"With this I feel like I have a game plan. I'm not flying blind. Yes, I'll use it."

Our hypothesis had been proven: People struggling with debt will benefit from a tool that feels like a trusted partner, giving specific and trustworthy payment advice for the next month.

More polished screen mockups were created by the design team, beginning with the first stories needed for development and expanding in collaboration with the product strategist and product manager. We designed mobile-first, as we wanted the solution to be easy to use on any device, and expanded designs to larger sizes once they were more established.

A design system featuring branding elements, objects, patterns, and styles was created to organize assets and keep them consistent within our tool, as well as pre-existing client UI assets for other tools.

Mockups, a flow chart, and the design system were housed in Invision for easy communication with the team and client.

I was able to consolidate our findings over time into experience maps that helped show how the tool was working for users, and where potential pain points and opportunties lie for the future.